Accounting

Earn Your Accounting Degree at Doane University

What Careers Will You Find With an Accounting Degree From Doane?

As an accounting major, you will learn to understand, analyze, report, and interpret accounting information as a decision-making tool in various organization structures. You’ll also exhibit effective communication skills to use in a variety of business contexts.

Our recent graduates have started their careers as a tax preparer, technology assurance associate and accountant at national firms like KPMG and national organizations like the National Horsemen’s Benevolent and Protective Association.

Auditors and Accountants

2018 Median Pay: $70,500

Management Analysts

2018 Median Pay: $83,610

Financial Analysts

2018 Median Pay: $85,660

Personal Financial Advisor

2018 Median Pay: $88,890

Financial Manager

2018 Median Pay: $127,990

Cost Estimators

2018 Median Pay: $64,040

Program Information

Managerial Accounting Major

Public Accounting Major

Accounting Minor

Faculty and Staff

CPA Exam Information

The Accounting program meets the educational requirements to apply for the Certified Public Accountant (CPA) exam with the exception of completion of 150 credits. Academic advisors at Doane work closely with students who are considering certification options. Students should contact their advisors immediately to ensure their course of study fulfills all requirements for their state of residence.

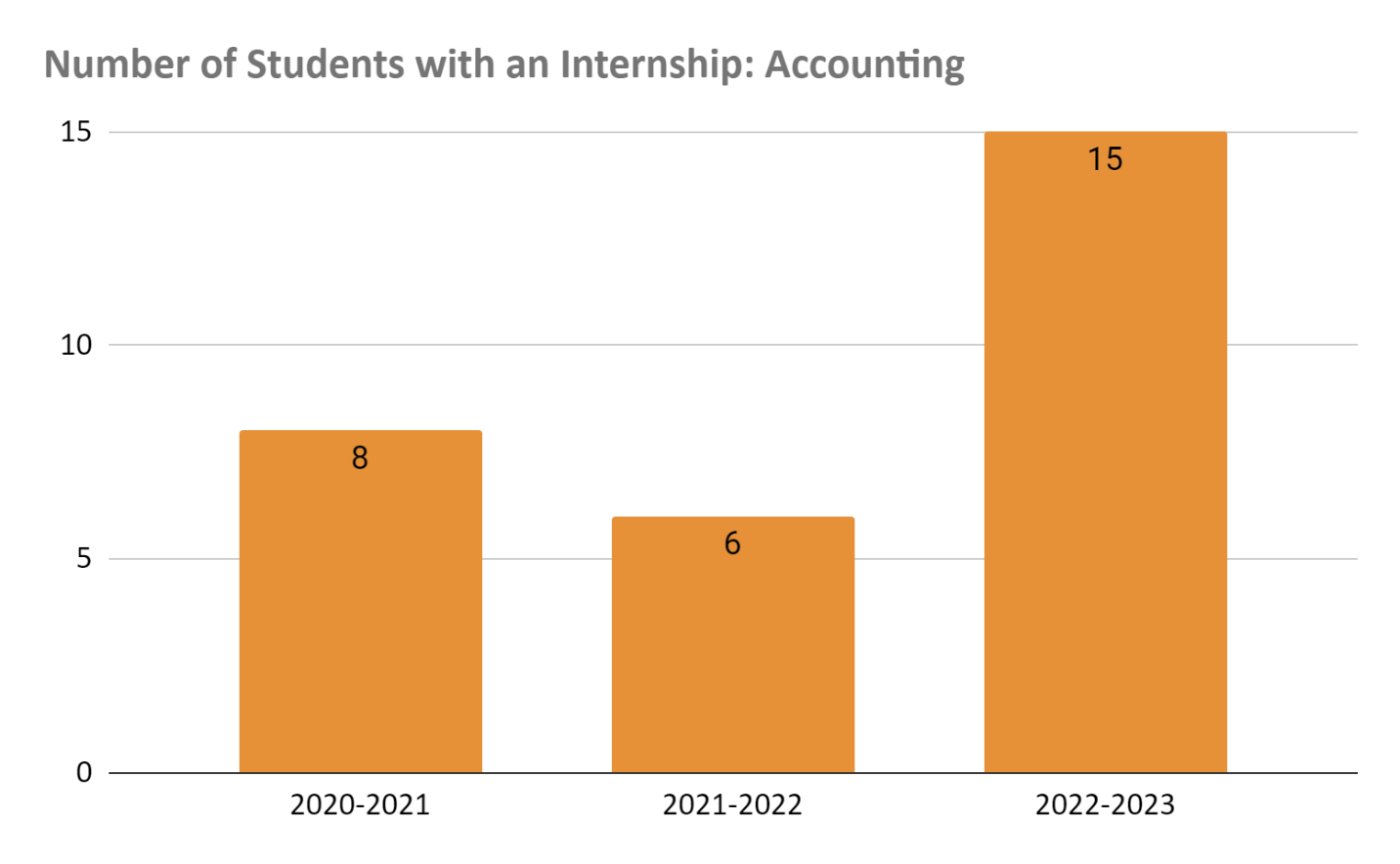

Internship Credits: Students majoring in Accounting who plan to take the CPA exam are required to earn 3 credit hours for internship experience or take BUS 496. Because internships are a valued part of the Accounting degree and help meet the 150-hour requirement to sit for the Uniform CPA Exam, accounting majors often take additional internship credits.

Students in locations with the status "HAS NOT BEEN DETERMINED" should consult the National Association of State Boards of Accountancy to verify the requirements for their location.

States for which Doane University has determined that its curriculum MEETS the state educational requirements for licensure or certification (with the exception of requiring 150 credits) includes:

Nebraska

States for which Doane University has determined that its curriculum DOES NOT meet the state educational requirements for licensure or certification includes:

N/A

States for which Doane University HAS NOT DETERMINED that its curriculum meets the state educational requirements for licensure or certification includes:

Alabama, Alaska, American Samoa, Arizona, Arkansas, California, Colorado, Connecticut, Delaware, District of Columbia, Florida, Georgia, Guam, Hawaii, Idaho, Illinois, Indiana, Iowa, Kansas, Kentucky, Louisiana, Maine, Maryland, Massachusetts, Michigan Minnesota Mississippi Missouri Montana, Nevada, New Hampshire, New Jersey, New Mexico, New York, North Carolina, North Dakota, Northern Mariana Islands, Ohio, Oklahoma, Oregon, Pennsylvania, Puerto Rico, Rhode Island, South Carolina, South Dakota, Tennessee, Texas, U.S. Virgin Islands, Utah, Vermont, Virginia, Washington, West Virginia Wisconsin, Wyoming

You can find more information regarding licensing in the state of Nebraska here.

Flexible Options for Adult Learners

Courses on the Lincoln campus are offered in 8-week terms to provide flexibility to adult learners.

Skills Development

100% of graduates in 2023 say they use more analytical, creative, and effective thinking skills when considering issues and problems.

100% of graduates in 2023 say they communicate in a manner that is more purposeful, context appropriate, and conveys a clear message.

100% of graduates in 2023 say they are better able to articulate the knowledge and skills needed for future personal and professional development.

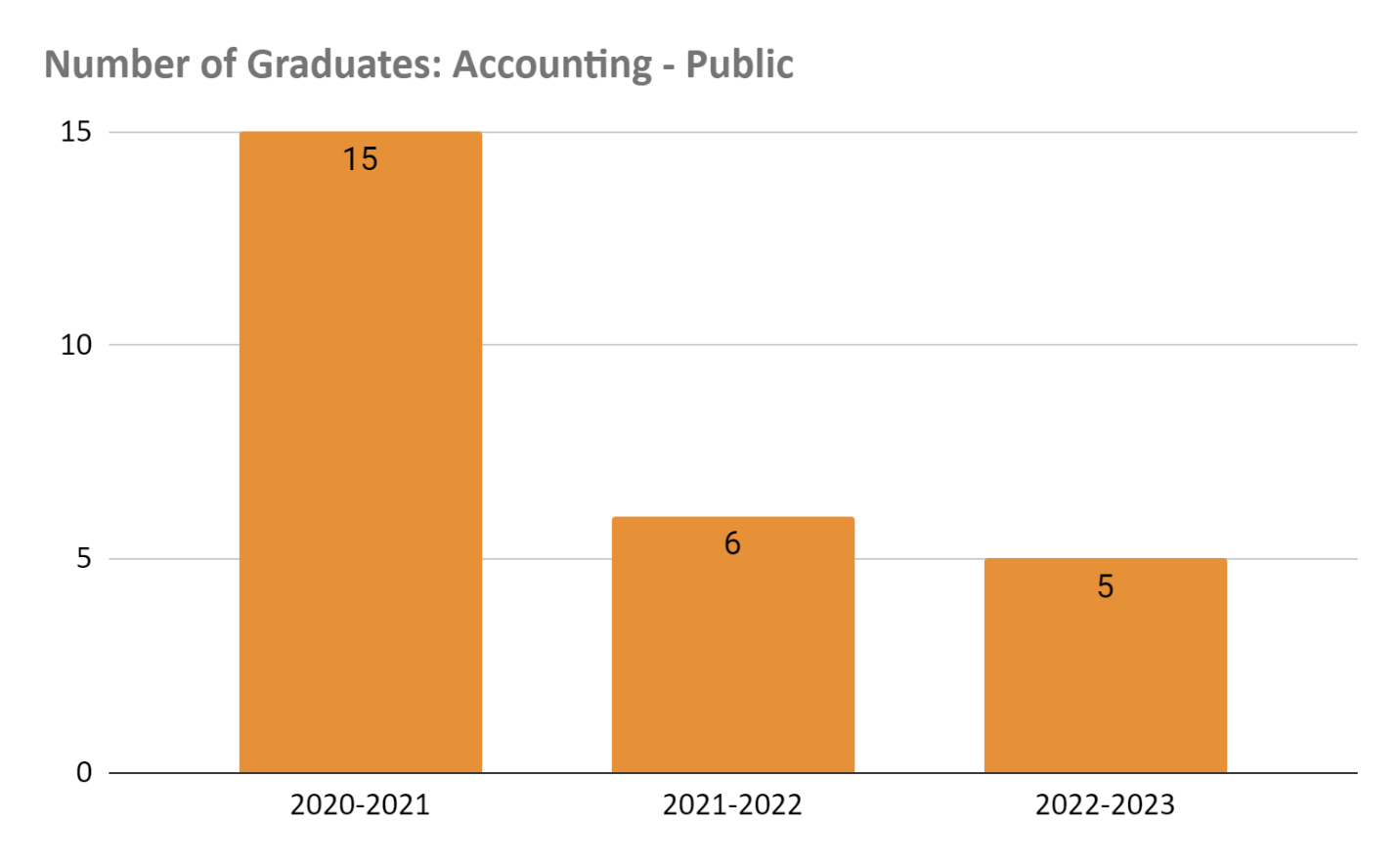

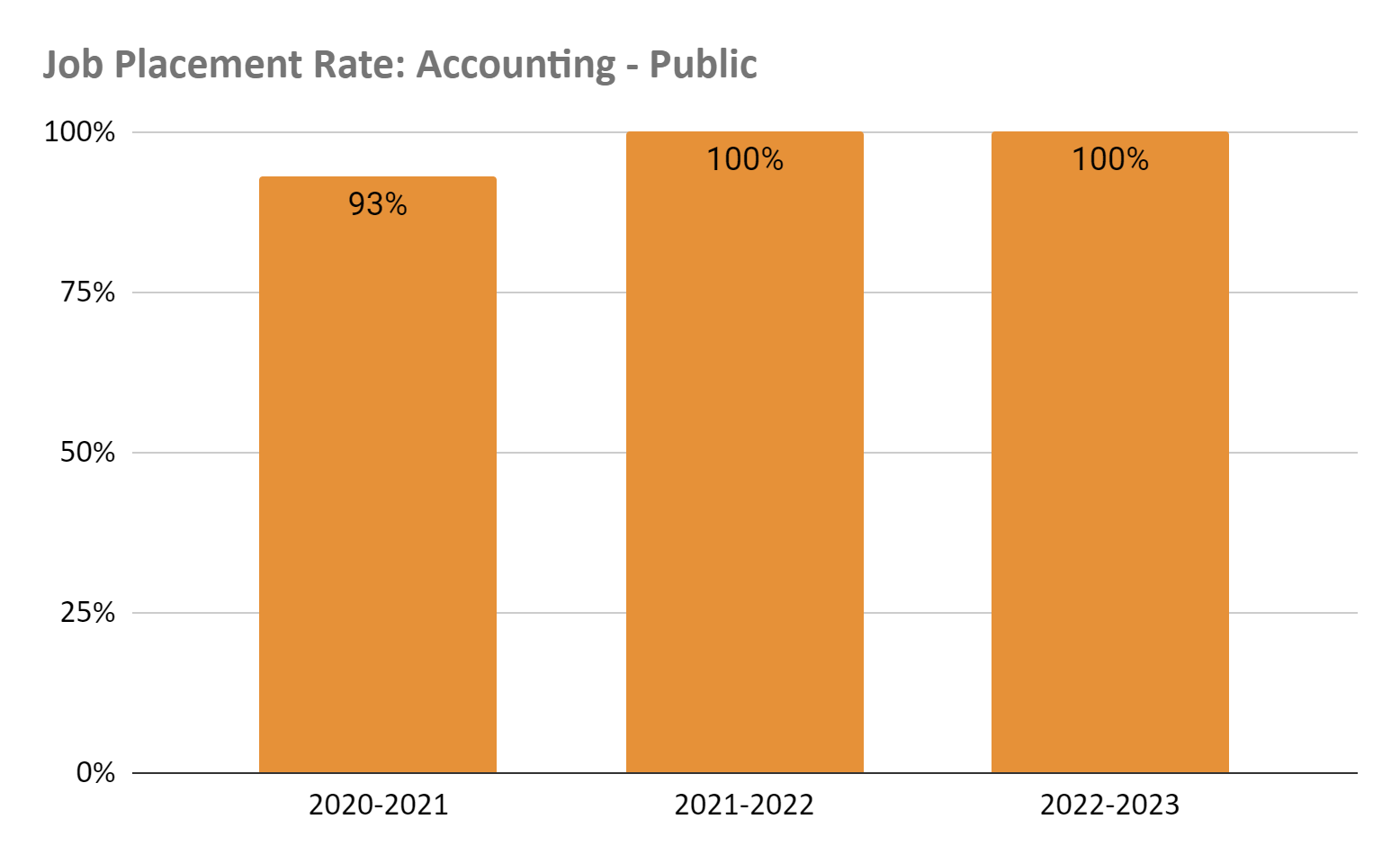

Job Placement

100% of graduates in 2023 were not seeking employment (i.e., they are employed, in graduate school, etc.)

Jobs of 2023 graduates:

- Accountant

- Tax Preparer

- Technology Assurance Associate

Places of Employment for 2023 graduates:

- Modern Accounting

- KPMG

- HBPA

- Doane University

2023 graduates will work in Nebraska and Iowa

The Doane Difference

When asked, "what one thing significantly helped your ability to complete your Doane experience?" students commented on the small class sizes, the personalization of their education and the relationships they build.

Public Accounting Major: ACBSP Accreditation – Candidacy

Doane University’s Public Accounting Major is a candidate for accreditation through ACBSP.

Accreditation Council for Business Schools and Programs (ACBSP) is a global business education accrediting body and the first organization to offer accreditation to all levels of collegiate business educational degree programs from associate to doctoral. ACBSP ignites a standard of excellence with an accreditation process based on the Baldrige Education Criteria for Performance Excellence. By evaluating aspects of leadership, strategic planning, relationships with stakeholders, quality of academic programs, faculty credentials, and educational support, ACBSP assesses whether or not business programs offer a rigorous educational experience and commitment to continuous quality improvement.